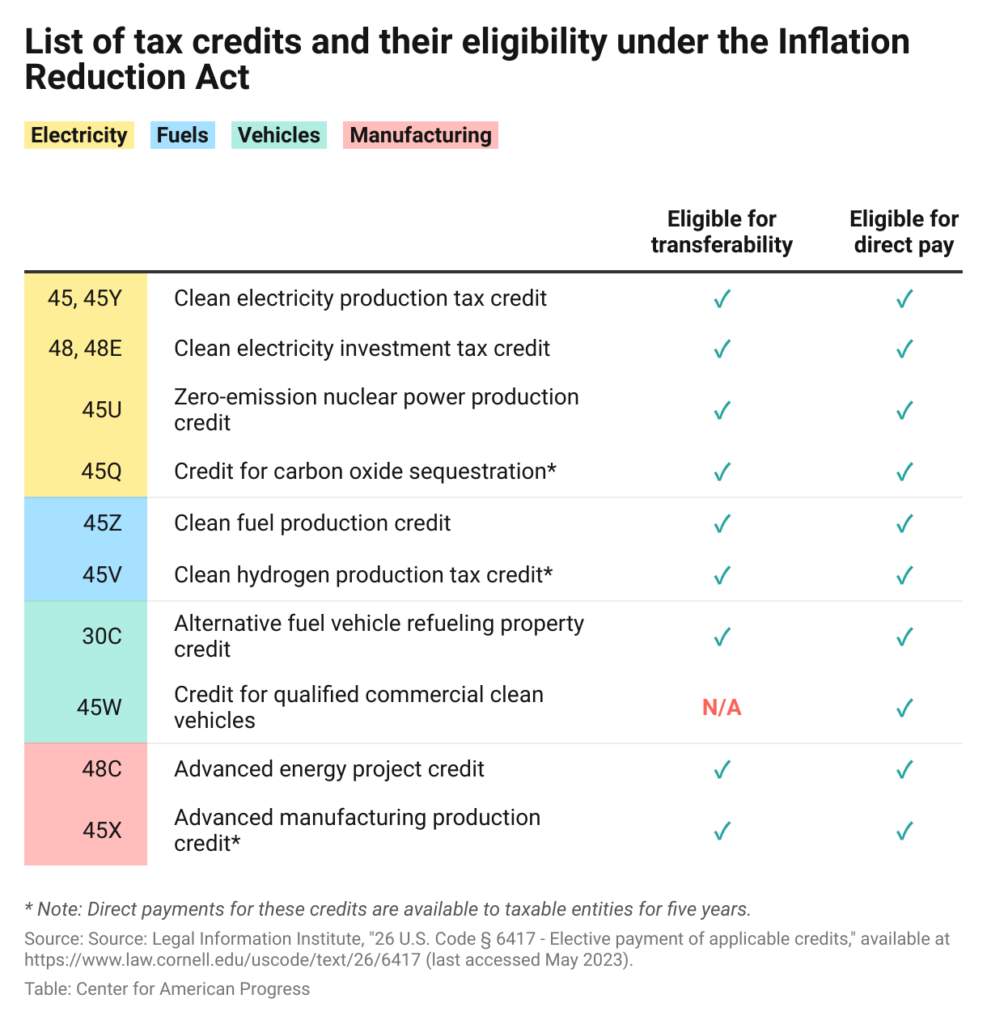

The Inflation Reduction Act of 2022 (the “IRA”) has significantly expanded the opportunities for all renewable energy transactions. It expanded the timeframe for credit availability to 10 years, creating unprecedented certainty for the investment runway.

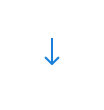

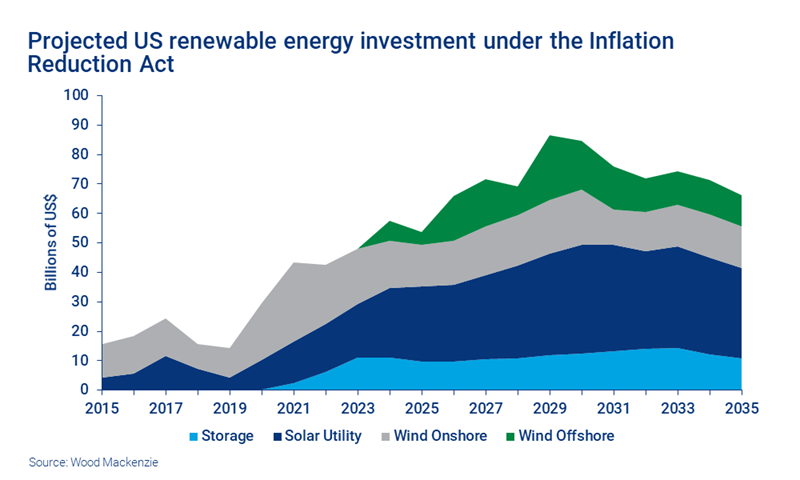

The IRA also expanded the asset classes eligible for incentives, now adding to wind and solar waste-to-energy facilities, stand-alone battery storage, green hydrogen, clean fuel production, carbon oxide sequestration, zero-emission nuclear power and a number of other clean technologies. In addition, the IRA increased the value of tax incentives, allowing “nesting” of credits within other incentives (e.g., a 30% base investment tax credit, an additional 10% for “domestic content”, an additional 10% for projects built in “energy communities”, etc.).

By qualifying a larger universe of eligible assets, the IRA is projected to increase the market for tax-incentivized investments by 8-10x over the next five years to approximately $80 billion.

In order to create additional investor demand to fund these projects, the IRA expanded the ranks of qualified investors able to participate in this market by adding tax-exempt investors. Tax-exempt investors are all organizations exempt from tax under section 501(a) of the Internal Revenue Code, such as pension funds, endowments, municipalities, Indian tribal governments, etc. These investors were previously unable to participate in energy transition as so-called tax equity investors because they do not pay taxes.

The IRA now allows these investors to participate by granting them cash pay ‘refunds’ (i.e., direct cash transfers from the government) for the credits they earn through investing in qualified renewable energy projects. These renewable energy projects can be solar, wind, renewable natural gas, battery storage, carbon capture, and all other types of projects supported by the IRA.

On June 14, 2023 the Department of the Treasury issued much anticipated proposed and temporary regulations (the “Guidance”) that provide details on how tax-exempt investors can actually participate in renewable transactions. An important takeaway from the Guidance is that the use of partnerships, traditional vehicles for renewable energy investing, is not available to tax-exempt investors for most renewable energy transactions (there is a narrow exception for relatively novel technologies such as clean hydrogen production, carbon sequestration and advance manufacturing).

Most tax-exempt investors who desire to invest in more established technologies will still be able to do it in an arrangement where each investor will hold its investment as a “tenant-in-common”, or through a partnership that has elected to not be treated as a partnership for US federal income tax purposes. This means that tax-exempt investors will not be able to rely on established “tried-and-true” investment vehicles. Instead, new vehicles are currently being developed by renewable energy professionals and their counsel that will accommodate this new market.Major law firms have sent out client alerts detailing the recently issued final regulations from Treasury. This one from Vinson & Elkins provides a good summary.

Under the Guidance, tax-exempt investors cannot purchase credits from someone else’s deal and still qualify for direct pay. The credits have to come from their own investment. This provision may change in the future since the Treasury has asked for additional comments on this point.

The election to qualify for direct pay is required to be made on the tax return for the year in which the credit was generated. The election must be made on a separate project basis. Once made, the election will be irrevocable for the life of the credit. Each investor must pre-register the credit and include the registration number on its tax return at filing (for a tax-exempt entity, this would not be on an income tax return, but on the information return it usually files with the federal government).

If a tax-exempt entity has financed its investment with government grants or other similar financing sources, such grants will not reduce the amount of the available tax credit subject to direct pay, as long as the sum of the tax credit and the grant do not exceed the basis of the renewable energy project.

Entities electing direct pay are still subject to the five-year recapture rules that generally apply to all renewable energy project investors.