This sounds wonky but bear with me. We need liquidity to pay our bills, settle our debts – credit card and mortgage. We need either to have cash in our current bank account, or assets we can turn into cash at very short notice, preferably same day. Not all assets are liquid in a useful timeframe. We may have real estate that has gone up in value since we bought it, but we can’t sell it quickly to raise cash to pay our bills. We can take out a mortgage – borrow money – against it, but finding a mortgage is not a rapid process these days. Also, it just kicks the can down the road because we need to pay for that mortgage…and you need cash for that. We may have investments we can turn into cash immediately – they count. Investopedia defines liquidity as follows:

“Liquidity refers to the ease with which an asset, or security, can be converted into ready cash without affecting its market price. Cash is the most liquid of assets, while tangible items are less liquid.“

As I just said, borrowing against assets can produce short-term liquidity, provided you have the time to get a loan, or have access to that most tempting of facilities, the Home Equity Line of Credit (HELOC). Encouraged by low-interest rates, the world has been on a borrowing spree since the global financial crisis (GFC) and asset prices have risen accordingly.

Current estimates vary as to the amount of debt worldwide. Over $300T, probably closer to $350T. The magic of compound interest will see that growing, assuming around 3% interest rate, at over $60T per annum. The average maturity is around 5 years, which means $70T needs to be refinanced every year. Refinanced, not repaid. Provided that debt can be refinanced every year, the party continues. If it can’t – and that is what happened during the GFC – there’s a problem. About 1/3 of the total debt outstanding is owed by governments/public sector. About 1/4 by households; and the rest by businesses. When interest rates were at zero, or close, which they were for maybe 20 years (excluding credit card debt) debt is very manageable. With short-term interest rates at 5%+ (for the US government, more for everyone else), the picture is very different.

Liquidity is a very different thing for a government, especially the US government, than for individuals or businesses. If an individual or a business can’t refinance its debt at maturity, it may lose the asset pledged to secure the borrowing or go bankrupt. Government, especially the US government, can just issue more debt to refinance the existing debt plus interest. If there are no willing buyers, it can manipulate the market to create them. The most conspicuous example of this would be to adjust the regulatory regime for banks and allow them to hold government debt with no limitation. Usually, each risk-weighted asset (RWA) that a bank holds requires them to set aside a certain amount of equity capital. Governments can easily require no capital to be set aside aginst government debt and thereby induce banks to buy their debt.

Liquidity in broader economic terms is often referred to in terms of monetary policy. Monetary policy is either loose or tight. Right now, it’s supposed to be tight. Well…

At well over $95T global M2, a measure of money circulating in the economy, liquidity has flattened out in 2023 and 2024, but it has gone straight up and to the right (SUATTR) since the global financial crisis.

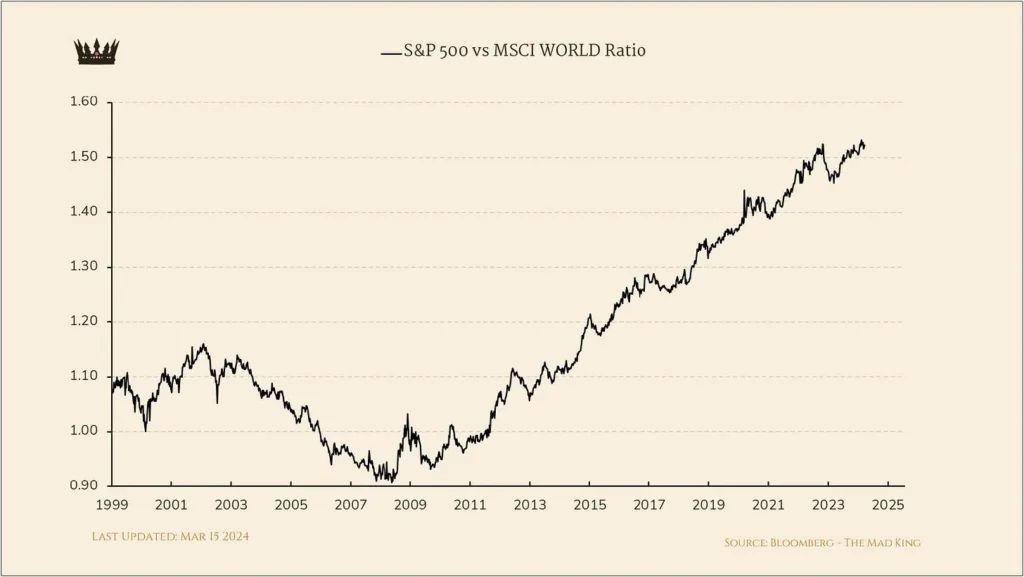

Something else that has gone SUATTR is the S&P 500 relative to Morgan Stanley Composite World Index. This means the S&P 500 has outperformed other world indices for a long time.

Perhaps the reason lies in the tide of overseas money flooding into the US markets.

In other words, tying this back to the theme of today’s post, the US equity markets have been a huge beneficiary of foreign liquidity invested in the US. As well as discharging its mandate to maintain an orderly treasury market, the Federal Reserve also needs to pay close attention keeping all that foreign money in the US.

I am going to stop short of my word target today because firstly I need to do some more research and, secondly, I think this is already enough for whatever audience this is finding. My concluding point for today – and until I finish the book I just came across, Capital Wars by Michael Howell (see endnote for more on Michael) – is that liquidity probably matters more than anything else in financial markets and life. Lack of it moves prices in markets and plays havoc in the lives of individuals. Always keep your eye on liquidity and make sure you have it when you need it.

In case you haven’t noticed, there is a ton of content you can pay for on the interwebs: podcasts, newsletters, and substack content. Sifting through to figure out which is worth the price of entry is challenging. As part of what I do here, I may make recommendations. I try to select sources that may not always reinforce my views on a range of topics. Sometimes it hurts to hear or read things that you don’t necessarily agree with. It hurts me for sure, not quite as much as lifting two 24kg kettlebells above my head a few times, but hurts nevertheless. It’s too easy to have your opinions confirmed. You have to try harder than that. (You have to try very hard to lift two 24kg kettlebells above your head…unless you are like my friend Johannes who could easily lift me above his head several times, if only I had handles!)

Michael Howell

Michael has recently appeared on two podcasts: Hidden Forces with Dimitri Kofinas (first hour is free); and The Grant Williams Podcast (not free). He says more or less the same on both but I listened to both in order to reinforce the information I heard the first time around. Another great resource, if you are interested, is Luke Gromen’s Forest for the Trees newsletter (again, not free)