To be fair to Janet Yellen, it is not entirely her fault. The tag team is Treasury Secretary and Fed Chair, so the current duo is Janet Yellen and Jay Powell. It may be that no duo has acted as closely as the current pairing. (Hank) Paulson and (Timothy) Geithner; Geithner and Bernanke; Mnuchin and Powell; Yellen and Powell. The Geithner/Paulson/Bernanke trio were forced to work very closely during the Global Financial Crisis (GFC), but that was primarily to keep the wheels on the bus (which, forgetting Lehman Brothers, just about worked). Yellen and Powell are working together to ensure that the policies of the Biden administration are properly carried out.

Let’s step back a bit and review the roles of Treasury and the Federal Reserve (Fed).The Treasury exists to collect government revenues – individual income taxes, corporate taxes, excise taxes – and issue the debt required to fund the shortfall between tax receipts and the various expenditures the government is responsible for – entitlements, defense, social security, healthcare, interest on government debt. The Fed is responsible for setting interest rates, managing the money supply and regulating the financial markets. These are the traditional roles.

Within those roles is a long list of things each has to worry about. Yellen is concerned about international trade because the Treasury issues its debt not only to domestic investors but also to international investors, many of them sovereign lenders such as the government of China and Japan. Since the post WWII Bretton Woods agreement, the US has patrolled the world’s oceans and made international trade safe and cheap. As countries such as Japan and Germany rebuilt and became manufacturing and exporting superpowers, many of the goods sold came to the US and were paid for with Treasury Bonds. When China joined the World Trade Organization in 1994, this trend was turbo-charged as China’s economy grew and, with ample government subsidies, it began to outcompete the production costs of the rest of the world and export its goods. The US, as the world’s largest single market has seen the biggest slice of this. This quote in a Wall Street Journal article from Yellen’s recent trip to China illustrates the point:

“Like other economists of her generation, Yellen, 77 years old, said the surge in Chinese exports at the start of the 21st century had seemed like a positive development, providing low-cost goods to global consumers. But the inexpensive exports also helped hollow out the U.S. manufacturing base in what became known as the China shock, leaving Americans out of work and fueling a political backlash to globalization.”

This from Yellen:

“People like me grew up with the view: If people send you cheap goods, you should send a thank-you note. That’s what standard economics basically says. I would never ever again say, ‘Send a thank-you note.’ ”

Yellen’s stated aim in her recent trip to China was to address the perceived threat from China exporting cheap solar panels and electric vehicles (EVs). The fear is that China will subsidize and dump cheap panels and EVs on the US and Europe that will make it hard for US and European manufacturers to compete. Rinse and repeat the problem highlighted by the WSJ article.

This creates massive tension with the policy of the Biden Administration to restore manufacturing and incentivize the manufacturing of all aspects of the supply chain powering the green energy transition (excellent article by The Oregon Group). She needs to keep the Chinese sweet as holders of Treasury debt and also be tough on trade. She does not, as the Chinese try to, seek to control the current account (the net deficit or surplus produced by imports and exports), the capital account (the net of investments and liabilities) and the exchange rate. Generally, the US allows these things to be determined by the market. The interplay of these three things, driven by global capital flows, is what Yellen worries about.

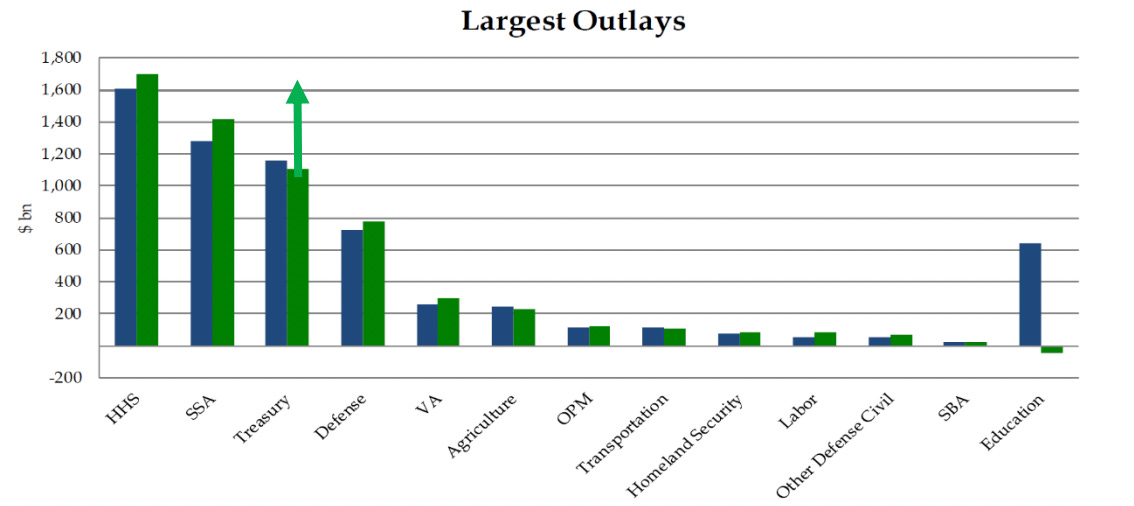

When the Inflation Reduction Act was passed in 2022, it scored the cost of the various incentives – tax credits – at $489B. In November 2022, Credit Suisse scored them at $800B. In March 2023, the Brookings institution scored them at $780B. At the same time, Goldman Sachs scored them at $1.2T. It is hard to tell because the government doesn’t know precisely how many qualifying assets and projects will be funded and built. These incentives, of course, are provided from government funds and, since the incentives take the form of tax credits and the primary source of government funding is taxes, the challenge is clear. Bank of America’s Michael Hartnett see interest expense going to $1.6T in 2024.

Back to the Fed who has to manage the impact that all these things have on the domestic economy. Spending and trade affect inflation and inflation is tied up with interest rates; interest rates are tied up with the money supply, which is heavily tied to global liquidity and capital flows.

In some ways, the respective roles of the Treasury Secretary and Fed Chair are similar to those of a CEO and. CFO. A happy world for Yellen is one where the USD exchange rate is comparatively weak, encouraging US exports and making Chinese imports more expensive. She doesn’t mind some inflation because it will increase nominal GDP and, provided this doesn’t push up interest rates on the debt she issues beyond her ability to fund the interest payments, she is happier still because inflation tends to reduce the amount of debt relative to GDP, which is a good thing – for her (not so much for the consumer).

At this point, she has to turn to her Fed Chair and make sure that level of interest rates stays manageable – a close relationship between the two helps enormously. This can be accomplished if the Fed buys the debt and accepts a lower rate of interest than the market would demand – so-called quantitative easing – but, because the Fed is not doing that at the moment (actually it is going in the opposite direction and reducing the amount of Treasury debt it holds), the Fed needs to do something else. That something else will likely be to make it easier for the banks to buy Treasury debt by allowing them to do so without having to allocate capital to owning Treasury Bonds. Since the banks are able, at present, to fund themselves cheaper than the government can (think how much JP Morgan pays on its deposit accounts…), they can make a nice profit from owning Treasury Bonds if they don’t have to set aside capital to do so.

But…

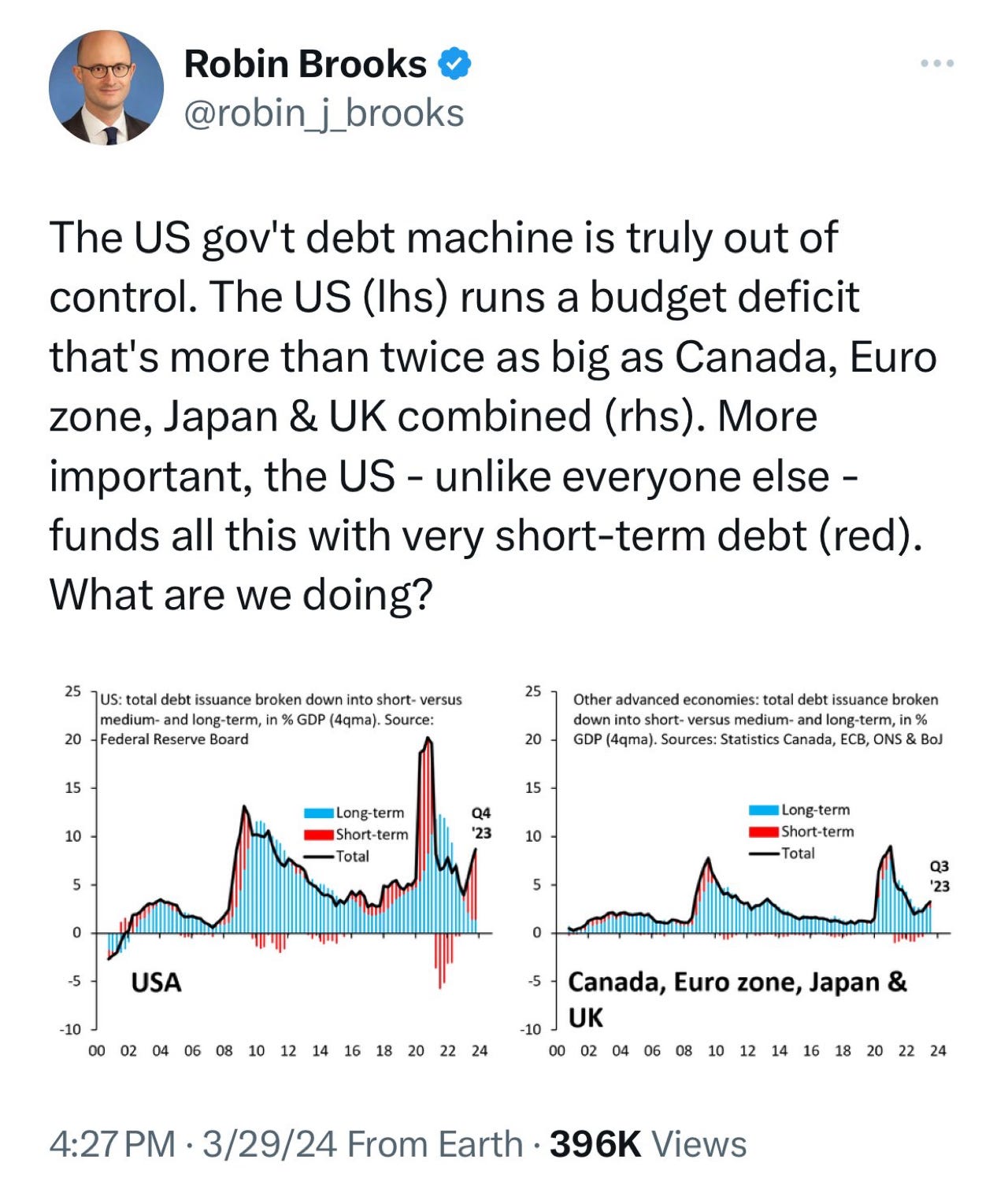

As Robin Brooks points out, at some point this begins to matter. It has been typical historically for the US to fund itself 80% in longer-term bonds – 5 or 10 or 30 years – and 20% in the short-term bill market. Recently, this relationship has been inverted, most likely because the investor interest in the longer -term maturities is not strong. Why, after all, would you lend the government money long-term at a rate lower than you can get short term, if you have the concerns that Robin Brooks alludes to above?

President Biden is on record as saying he thinks interest rates are going to come down soon, Inflation remaining strong is not helping this, so Yellen and Powell have to work hard pulling the levers they control to make sure they keep their jobs. Or, maybe they would rather leave sorting all this out to the next incumbents.